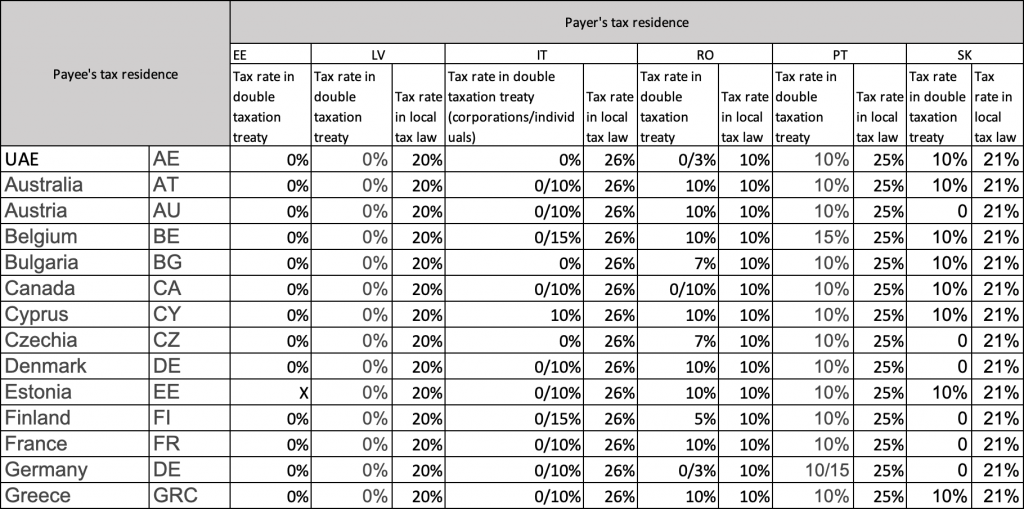

Withholding tax on a savings account is calculated at the top marginal tax rate of 45 per cent with the additional Medicare levy of 1.5 per cent. Withholding tax applies to non-residents of Australia as well, and for them, the withholding tax rate is 10 per cent. Withholding tax comes into effect if your saving account earns more than $120 per.. Interest Withholding Tax - Common Issues. By The Tax Institute - March 21, 2019. Australia imposes interest withholding tax (IWT) of 10% on interest paid by Australian resident borrowers not acting at or through a permanent establishment outside Australia; or non-resident borrowers carrying on business in Australia at or through a permanent.

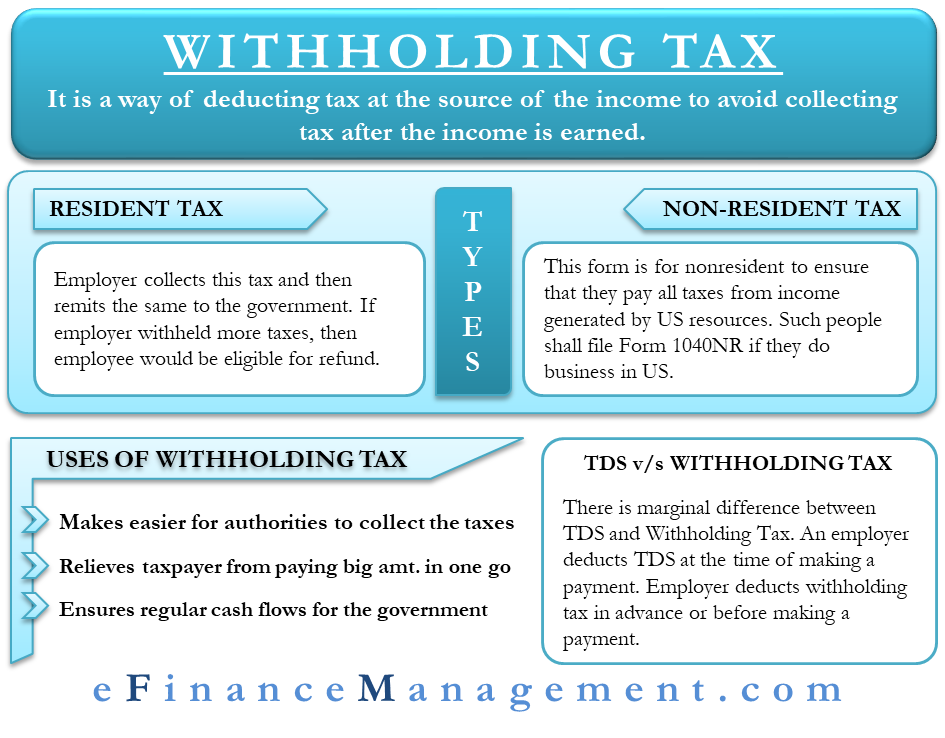

Withholding Tax All You Need To Know

Hong Kong residents withhold tax on behalf of nonresidents (2024) Mexus 會計事務所

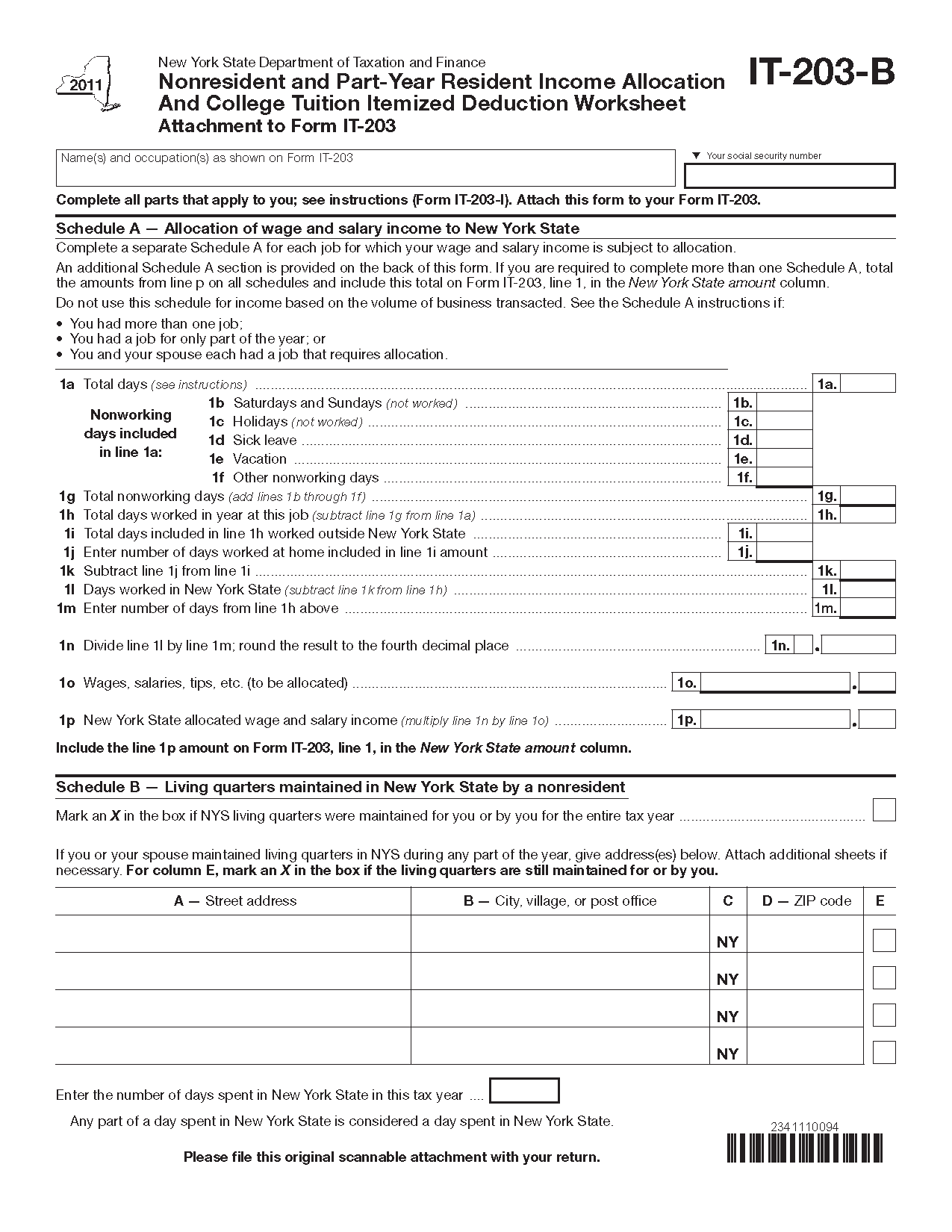

New York City Part Year Resident Tax Withholding Form

How is Interest from your Investments taxed? Personal Finance Plan

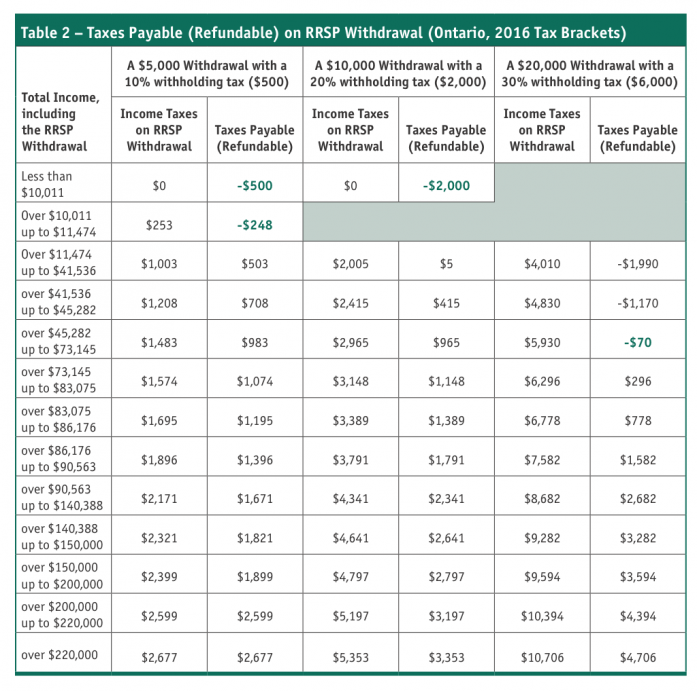

Understanding The RRSP Withdrawal Withholding Tax Canadian MoneySaver

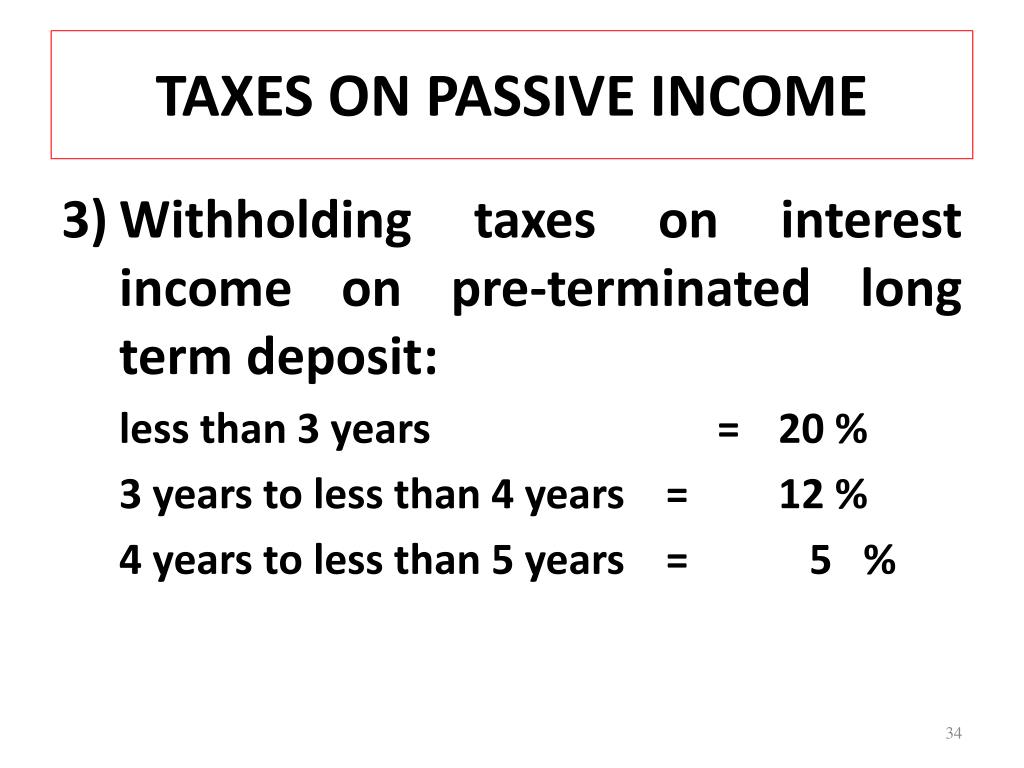

WITHHOLDING TAXES. ppt download

PPT BENEFITS AND PRIVILEGES OF SENIOR CITIZEN PowerPoint Presentation ID3248606

NonAustralian Resident with Interest Individual Tax Return (ITR) LodgeiT

what is withholding tax malaysia Andrew Ellison

Final Withholding Tax under TRAIN Law

Withholding tax on interest payments FKGB Accounting

[Solved] Please note that this is based on Philippine Tax System Please put... Course Hero

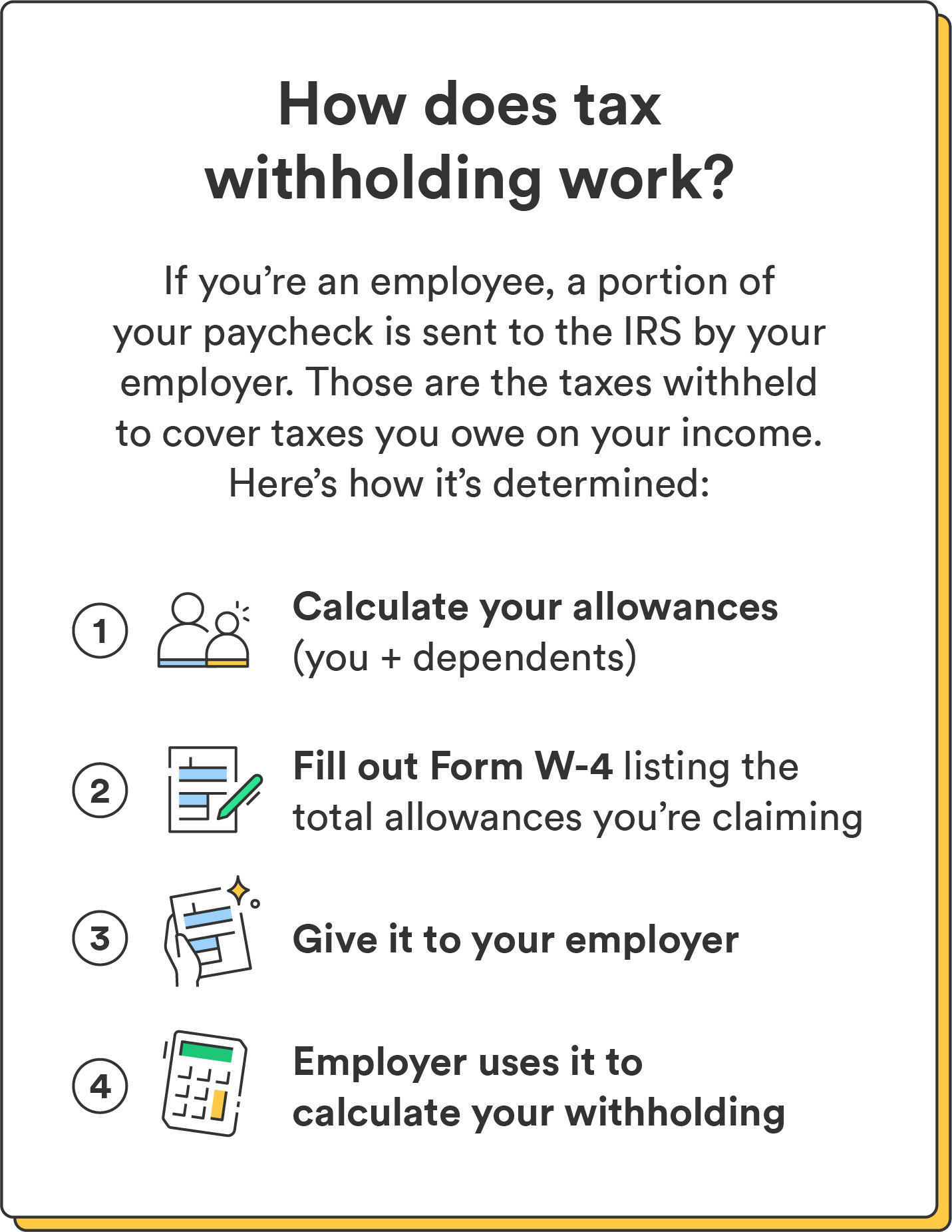

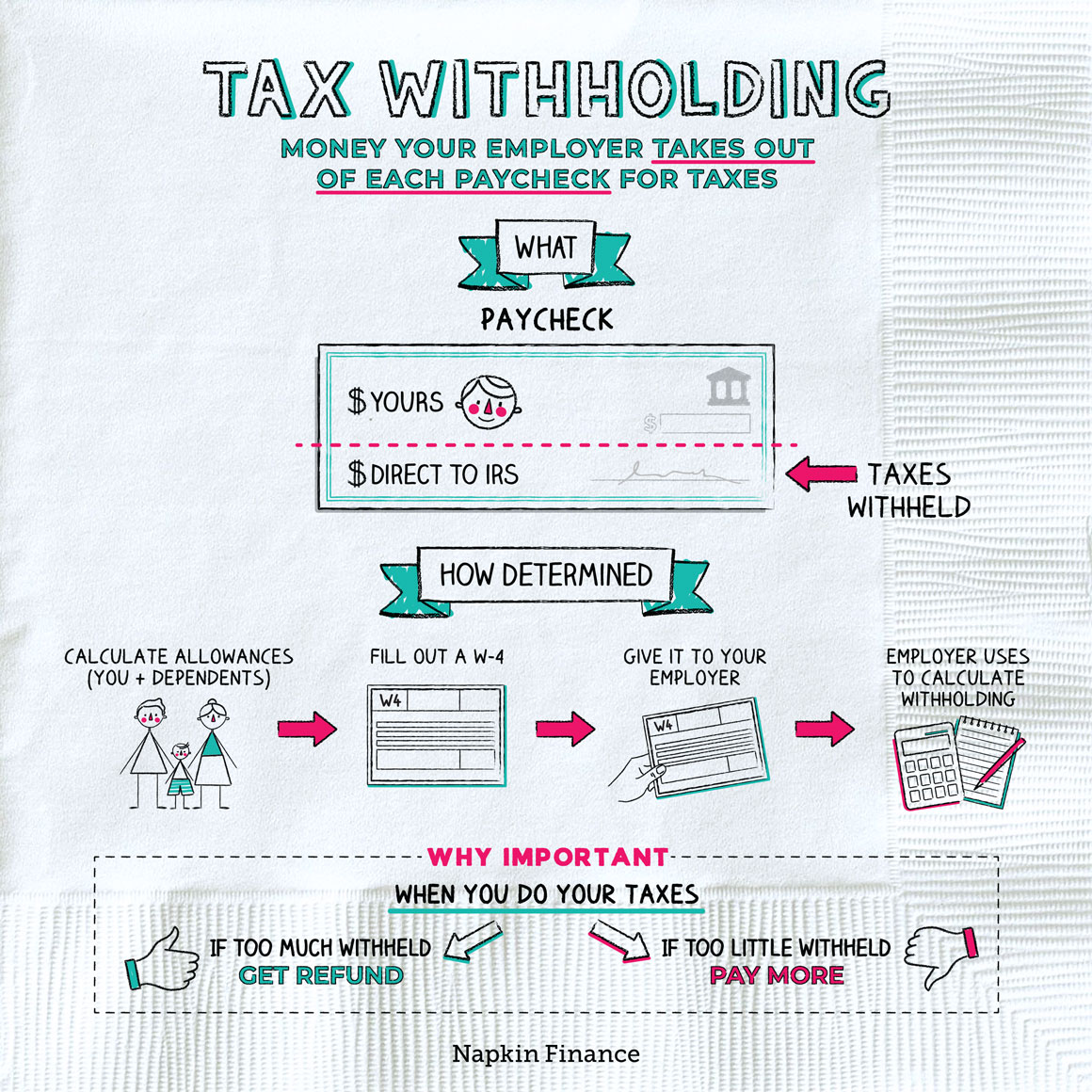

What Is Tax Withholding? Chime

(PDF) Withholding tax on interest Who has the withholding obligation?

Withholding tax and interest rate

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

Tax Withholding Exemptions Explained Top FAQs of Tax Jan2023

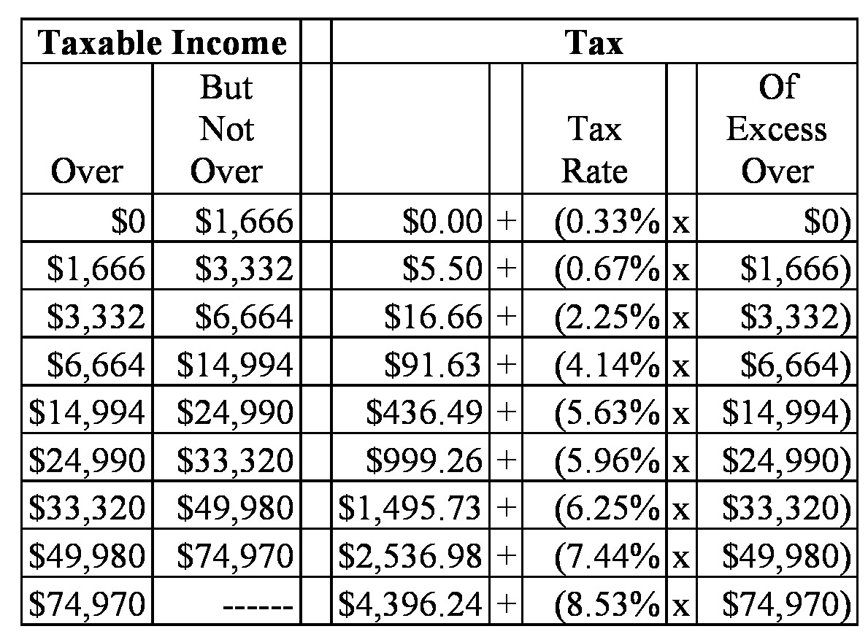

IDR 2020 interest rates, standard deductions and tax brackets WiltonDurant Advocate News

How To Avoid Withholding Tax Economicsprogress5

How to Withhold Taxes from Railroad Retirement — Highball Advisors Railroad Retirement Specialists

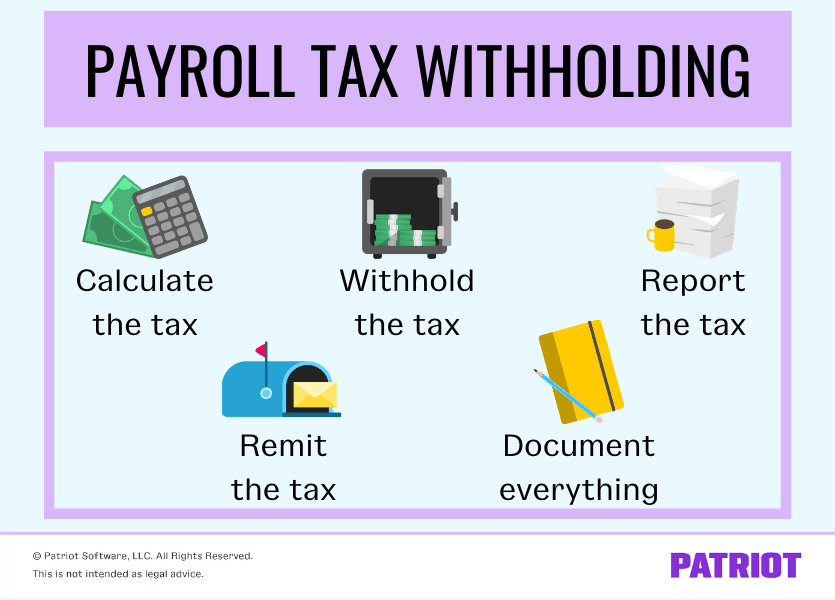

The Basics of Payroll Tax Withholding finansdirekt24.se

Resident Withholding Tax (RWT) is a tax that ANZ has an obligation to withhold from certain payments of investment income - including interest or dividends - to New Zealand resident customers or third parties. Any RWT withheld by ANZ is paid to Inland Revenue on the recipient's behalf. The rate at which RWT is deducted from interest will.. As a guide for the 2021/22 or 2022/23 financial years, if you earn between $45,000 and $120,000, the marginal tax rate for each dollar over $45,000 is 32.5%, plus the Medicare levy which is 2% of your taxable income. So you could pay tax of up to 34.5% (including the Medicare Levy) on interest earnings. In contrast, resident withholding tax.